Can I Prepay Property Tax in Pittsburgh Pa

Prepayment of Montgomery Canton Real Property Taxes

You may prepay a portion of your Real Property Taxes for the next levy twelvemonth, past using the following process only.

You may prepay taxes past (1) completing and signing the Observe of Intent, and (2) mailing a check to the Dept. of Finance, Division of Treasury, or by bringing your payment in person to the Dept. of Finance, Sectionalisation of Treasury.

Do not post your payment to any other address. The only address for mailing Prepayments or for bringing Prepayments in person is:

Department of Finance, Division of Treasury

ATTN: PREPAYMENT OF TAXES

27 Courthouse Square, Suite 200

Rockville, Md 20850

Prepayments in person at the Division of Treasury can exist fabricated in the form of cash or check. Payments volition exist accepted during the hours of 8 a.thou. to 4:30 p.m.

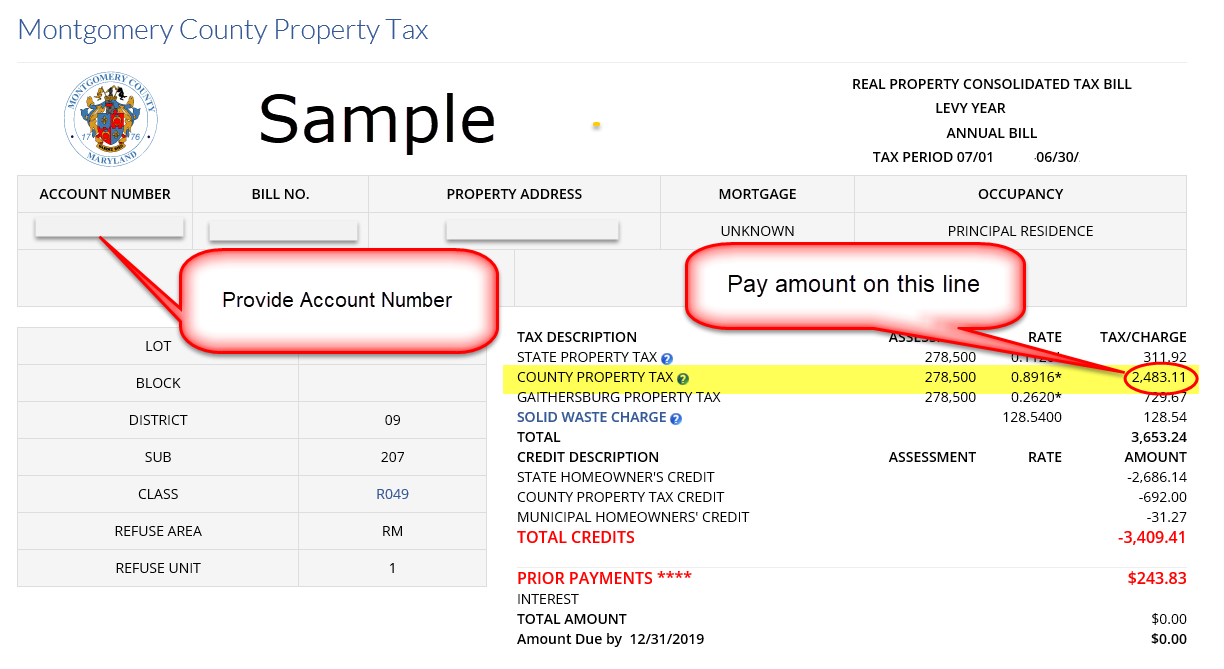

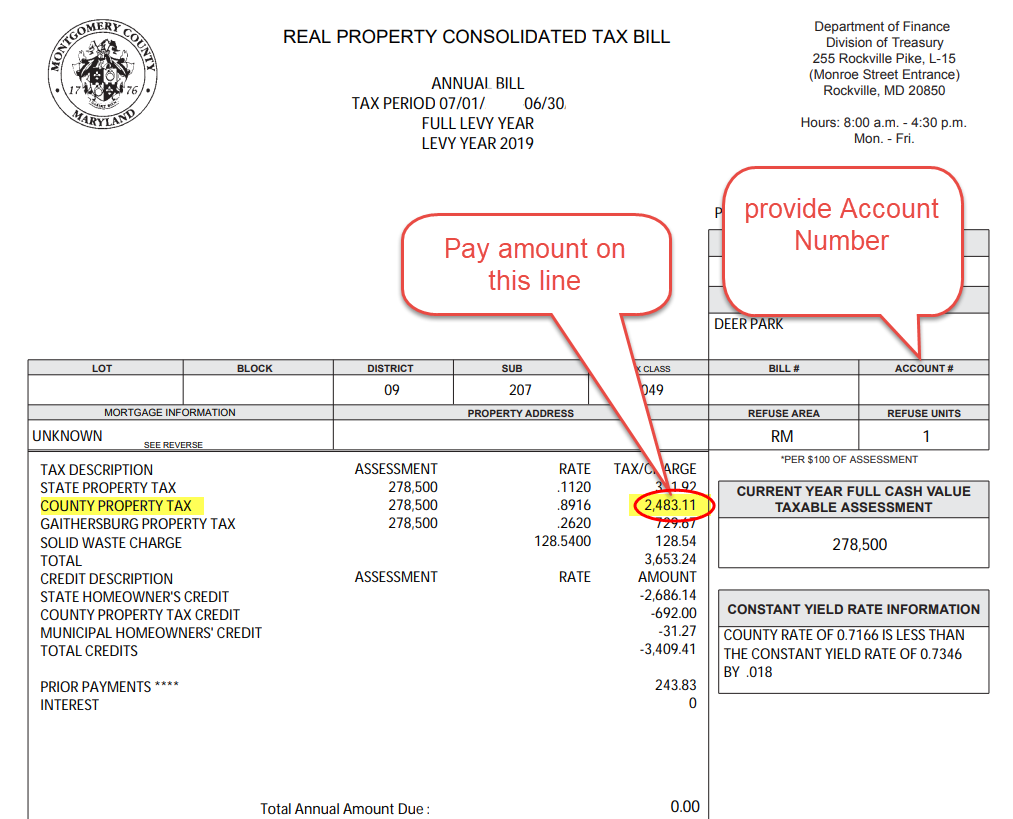

The only amount that y'all will be allowed to pay is equal to the amount on the current levy year Canton Existent Property Tax that is listed equally "County Property Taxation." Do not pay any other amount, or the payment will be rejected. Delight meet the examples below—the samples prove which line to look for to determine the amount that can be paid. When paying in person, bringing with you a copy of your current levy yr tax pecker will expedite the process, as information technology shows the County tax amount billed. If you do not have a copy of your current levy year tax bill you can impress information technology out past looking up your property at https://apps.montgomerycountymd.gov/realpropertytax . Yous must pay ALL amounts due on the electric current and prior year taxes before prepaying the upcoming year taxes.

In that location will be no online viewable tape of your prepayment of tax until there is a new year tax bill posted and available in the tax arrangement, at which time the prepayment volition then exist posted to your new twelvemonth tax neb. Tax bills are usually candy at the offset of July.

You must sign the

Find of Intentto prepay your next levy year tax nib. Delight bring a signed copy of the Observe of Intent to expedite this process. No payments will be accepted without a signed Discover of Intent.

The Observe of Intent will also serve equally your receipt, if you lot pay in person at the Division of Treasury.Payments made in person by any person other than the taxpayer must exist accompanied by a letter of the alphabet from the taxpayer authorizing the person to make that payment. The letter of the alphabet authorizing the payment must be signed by the taxpayer, and the taxpayer must impress his or her name under his or her signature.

In that location will exist no refunds of prepaid taxes earlier the prepayment is posted to your next levy twelvemonth real holding tax beak. Refunds will only be given if the prepayment results in an overpayment of the next levy yr taxes. Normally tax bills are processed in July, and payments are posted only later on the bills are processed. Prepayments of taxes volition not be posted until July 1 st of every twelvemonth, at the earliest.

What follows is a list of the items you need to be aware of to prepay your real holding taxes. Montgomery County does not provide tax advice and will non annotate on whether these taxes, or any other taxes, are or will exist deductible nether whatever Federal, State or County laws.

-

Please post your check to:

Dept. of Finance, Division of Treasury

You may also pay in person at the to a higher place address, using just checks or cash. This office is on the Monroe Street side of the edifice. Prepayments will be accepted only during normal business hours, Monday through Friday, from eight a.m. to iv:30 p.m. Please do not transport payments to any other address.

ATTN: Prepaid Property Taxes

27 Courthouse Square, Suite 200

Rockville, MD 20850

- Taxpayers must sign a Notice of Intent or prepayment will not be accepted. The Notice of Intent is bachelor here . No other forms of a Notice of Intent will be accustomed.

- Payments must be fabricated by cheque or greenbacks. No other form of payment volition be accustomed.

- The Find of Intent requires that you concord to the following:

- That you intend to prepay the upcoming levy Year County real property tax on the above described property every bit authorized under Section 52-2A of the Montgomery County Code. Your prepayment must equal exactly the amount from the "County Property Taxation" line on the current Levy Twelvemonth tax bill—you may non modify this amount in any way (for instance, past deducting any tax credits);

- If y'all owe any balance on your (or any prior year'southward) Existent Holding Consolidated Revenue enhancement Bill, your prepayment of the new upcoming levy yr for County real property tax will be used instead to pay the remainder due. If your prepayment exceeds whatever prior twelvemonth'due south balance, the over payment will be returned to you lot unless the over payment equals exactly the corporeality of County belongings tax owed for the immediate prior year Levy, in which example the prepayment volition be treated as a prepayment of your new/upcoming Canton belongings taxation as authorized under Section 52-2A;

- That your prepayment of the new upcoming levy year taxes is limited to the amount shown on the "County Property Tax" line on the tax pecker for the current year Levy, practise not deduct the amount of any tax credits from your payment; do not pay any amount other than the corporeality on the "Canton Property Tax" line.

- That your prepayment will be applied to your upcoming levy yr Real Belongings Consolidated Tax Bill, when that tax neb is available in the revenue enhancement system operated past the County;

- That there will be no refunds until in that location is a adjacent levy twelvemonth tax pecker for your account and the prepayment of tax is posted to your next levy year revenue enhancement beak. There volition merely exist a refund if the prepayment results in an over payment of the adjacent levy twelvemonth Existent Belongings Consolidated Tax Bill for the above described belongings;

- That the County will not pay whatever interest on the prepayment, including any interest on any refund attributable to the prepayment;

- THE COUNTY DOES NOT REPRESENT TO You THAT THE PREPAYMENT OF YOUR NEW UPCOMING LEVY YEAR COUNTY Holding Revenue enhancement MAY Exist LEGALLY DEDUCTED ON YOUR FEDERAL INCOME TAX RETURN. THE County ADVISES Y'all TO CONSULT WITH YOUR Own TAX ADVISOR Earlier DEDUCTING YOUR PREPAYMENT ON YOUR FEDERAL INCOME TAX RETURN;

- That your signed Notice of Intent will be your only receipt;

- That your prepayment will not bear witness upward in the tax system until in that location is a next levy year taxation nib for your account, and your prepayment has been posted to your next levy twelvemonth tax beak;

- That your tax business relationship will be charged an additional non-refundable fee of $35.00 for whatever check submitted that is returned past a financial institution for whatsoever reason, including a stop payment, bereft funds or closed accounts.

Examples of Locating the County Property Tax Amount

For your online bill:

For your impress bill:

Source: https://www.montgomerycountymd.gov/Finance/prepay/index.html

Posting Komentar untuk "Can I Prepay Property Tax in Pittsburgh Pa"